GA T-20A 2000-2024 free printable template

Show details

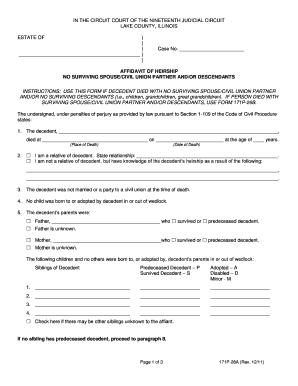

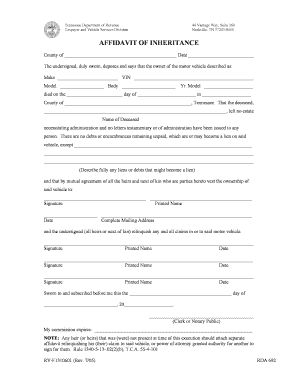

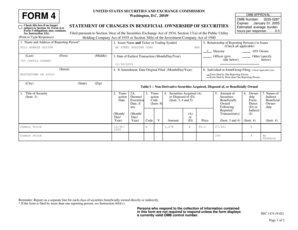

T -20A Rev. 6/00 Department of Motor Vehicle Safety Motor Vehicle Services Affidavit of Inheritance of Motor Vehicle Non-Probated Will With Limited Assets State of Georgia County Personally appeared before me the undersigned person who first being duly sworn certifies that the Deceased who at the time of his/her death was the owner of the motor vehicle described below which motor vehicle was the descendant s only asset and was not encumbered left a will with limited assets under which the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your t 20 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t 20 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t 20 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form t 20 affidavit of inheritance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out t 20 form

How to fill out T 20 form?

01

Gather all necessary information such as personal details, employment information, and financial records.

02

Carefully read and understand the instructions provided with the T 20 form.

03

Start by filling out the basic information section, providing your name, address, and contact details.

04

Proceed to provide the required employment information, including your job title, employer's name and address, and duration of employment.

05

Fill in the financial information section, reporting your income, expenses, and any assets or liabilities as required.

06

Double-check all the information filled in to ensure accuracy and completeness.

07

Sign and date the T 20 form before submitting it, either electronically or by mail.

Who needs T 20 form?

01

Individuals who are applying for a tax refund or credit.

02

Taxpayers who have various sources of income and need to report them accurately to the tax authorities.

03

Employed individuals who need to update their employment information for tax purposes.

04

Self-employed individuals or business owners who need to report their income and expenses for tax assessment.

05

Individuals who have experienced significant life events such as marriage, divorce, or the birth of a child and need to update their tax information accordingly.

Video instructions and help with filling out and completing t 20 form

Instructions and Help about how to georgia affidavit inheritance form

Fill 00 inheritance georgia : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is t20 affidavit of inheritance?

T20 Affidavit of Inheritance is a document that is used to provide proof of inheritance. It is used in cases where someone is claiming the right to an inheritance from a deceased relative. The affidavit must be signed by a witness who can testify to the validity of the claim, and it must be notarized. The affidavit must also include all relevant information about the deceased, the claimant, and the inheritance, such as the names and addresses of the parties involved, the date of death of the deceased relative, and a description of the inheritance.

What is the penalty for the late filing of t20 affidavit of inheritance?

The penalty for filing a T20 affidavit of inheritance late will depend on the jurisdiction in which the inheritance is taking place. Generally, penalties for late filing can include administrative fines or other court-imposed penalties. It is best to consult with a local attorney to determine the exact penalty.

How to fill out t20 affidavit of inheritance?

Filling out a t20 affidavit of inheritance involves providing specific information about the deceased person, their heirs, and their assets. Here are the steps to fill out the form correctly:

1. Download or obtain a copy of the t20 affidavit of inheritance form from the appropriate source, such as a court website or a legal document provider.

2. Start by entering the name of the court, estate, and the case number at the top of the form.

3. In the section titled "Decedent's Information," provide the full legal name, social security number, and date of birth of the deceased person. Also, include the date of death and the county where the person resided at the time of their death.

4. In the next section titled "Person Requesting or Beneficiary," provide your own full legal name, address, phone number, and relationship to the deceased.

5. Proceed to the section called "Property Information." List the description and location of each asset that is being inherited, including real estate, vehicles, bank accounts, investments, and any other significant properties. Be sure to include accurate and detailed information in this section.

6. In the section titled "Heirs," provide the complete legal names, addresses, and phone numbers of all the inheritors or heirs. Include yourself if you are an heir and provide your relationship to the deceased.

7. If any of the named heirs are minors, indicate their ages and provide the names and addresses of their legal guardians.

8. The last part of the form is the signature section. Date the form and sign it in the presence of a notary public. Make sure to complete this step after filling out the entire form.

9. Once the form is completed and signed, make copies for your records and submit the original to the appropriate court or estate administrator, as directed by the specific requirements of your jurisdiction.

Remember, filling out legal forms can be complicated, so it's always a good idea to consult with an attorney or a legal professional if you have any doubts or concerns.

What is the purpose of t20 affidavit of inheritance?

The purpose of a T20 affidavit of inheritance is to establish the rightful inheritance of a deceased person's property. This affidavit is typically used when the deceased person did not leave a will or testament, and it allows a designated person (usually the heir or beneficiary) to claim and transfer ownership of the property without going through a probate process. This affidavit is often used for smaller estates where the value of the property does not exceed a certain threshold specified by state law.

What information must be reported on t20 affidavit of inheritance?

The specific information that must be reported on a t20 Affidavit of Inheritance may vary depending on the jurisdiction, but generally, it includes the following:

1. Personal details: The full legal name, address, and contact information of the affiant (person making the affidavit) and the deceased person.

2. Date and place of death: The exact date and location of the deceased person's death.

3. Relationship to the deceased: The affiant must provide details about their relationship to the deceased person, such as being a spouse, child, parent, or other close relative.

4. Description of assets: A detailed list of the assets and properties left behind by the deceased person, including real estate properties, personal properties, bank accounts, investments, and any other valuable assets.

5. Value of assets: The value of each asset must be reported along with any associated debts or liabilities.

6. Intestacy status: Whether or not the deceased person left behind a valid will. If there is a will, the affiant should provide information regarding its location.

7. Beneficiaries: The names and contact information of all beneficiaries entitled to inherit the assets. This may include surviving spouses, children, parents, or other family members mentioned in the will or as determined by the intestate succession laws of the jurisdiction.

8. Outstanding debts: Any outstanding debts or liabilities owed by the deceased person.

9. Executor or personal representative: If there is an appointed executor or personal representative named in the will, their details should be included.

10. Signatures and notarization: The affidavit must be signed by the affiant, typically in the presence of a notary public or other authorized official who will acknowledge the signing.

It is important to consult with an attorney or legal professional to ensure that the specific requirements of your jurisdiction are met when preparing an Affidavit of Inheritance.

How can I send t 20 form for eSignature?

form t 20 affidavit of inheritance is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit t 20 affidavit of inheritance online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your inheritance agreement and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit t20 form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share affidavit of inheritance ga form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your t 20 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T 20 Affidavit Of Inheritance is not the form you're looking for?Search for another form here.

Keywords relevant to affidavit of inheritance form

Related to georgia affidavit inheritance

If you believe that this page should be taken down, please follow our DMCA take down process

here

.